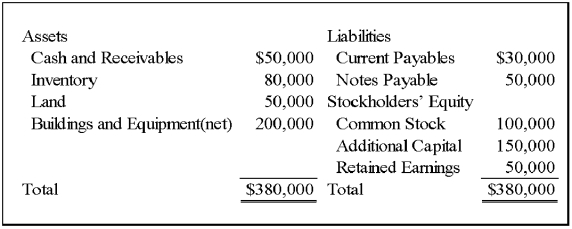

On January 1,20X9,Wilton Company acquired all of Sirius Company's common shares,for $365,000 cash.On that date,Sirius's balance sheet appeared as follows:

The fair values of all of Sirius's assets and liabilities were equal to their book values except for inventory that had a fair value of $85,000,land that had a fair value of $60,000,and buildings and equipment that had a fair value of $250,000.Buildings and equipment have a remaining useful life of 10 years with zero salvage value.Wilton Company decided to employ push-down accounting for the acquisition.Subsequent to the combination,Sirius continued to operate as a separate company.

-Based on the preceding information,what amount will be present in the revaluation capital account,when eliminating entries are prepared?

Definitions:

Economic System

The structure and methods by which a society decides on the allocation of resources and distribution of goods and services.

Goodwill

The intangible asset that arises as a result of the reputation, brand, or customer relations of a business, adding value beyond its tangible assets.

Intangible Capital

Assets that are not physical in nature, such as intellectual property, brand recognition, and human capital, which can contribute to a company's value.

Inventory

The total amount of goods and materials held in stock by a business, including raw materials, work-in-progress, and finished goods.

Q1: Based on the information given above,what amount

Q2: Mint Corporation has several transactions with foreign

Q6: Based on the preceding information,the cost of

Q16: Sets of statements devised to explain a

Q22: Based on the preceding information,what amount would

Q23: At the end of the year,a parent

Q25: The conditioned compensatory response occurs in response

Q33: Based on the preceding information,in the stockholders'

Q41: Based on the information provided,the differential associated

Q48: Tyler Company incurred an inventory loss due