Use the information below to answer the following question(s) :

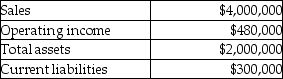

The Tandem division of the Great Adventures Cycles Company had the following results last year (in thousands) .

Management's target rate of return is 10% and the weighted average cost of capital is 8%. Tandem's effective tax rate is 35%.

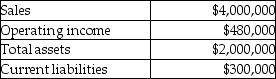

-The Tandem division of the Great Adventures Cycles Company had the following results last year (in thousands) .

Management's target rate of return is 10% and the weighted average cost of capital is 8%. Its effective tax rate is 40%.

What is the Tandem division's Economic Value Added (EVA) ?

Definitions:

Deflation

A decrease in the general price level of goods and services over a period, leading to increased purchasing power of money.

Market Risk Premium

The additional return an investor demands for taking on the risk of investing in the stock market over a risk-free rate.

Beta

A measure of the volatility, or systematic risk, of a security or portfolio compared to the entire market.

Portfolio P

This term typically represents a specific set of investments held by an individual or organization, potentially including stocks, bonds, and other assets.

Q34: Lincoln Transportation Services is considering a capital

Q43: The number of on-time deliveries would be

Q63: Performance evaluation systems are a way for

Q68: The following information describes a company's usage

Q75: Strait Corporation uses the following standard costs

Q83: The process of making capital investment decisions

Q84: The payback period for the Indiana proposal

Q99: _ regions in polymers make the polymer

Q194: What is the Entertainment Division's return on

Q196: The net present value model differs from