Use the information below to answer the following question(s) .

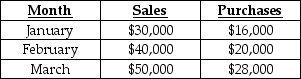

The following information pertains to Tiffany Company:

Cash is collected from customers in the following manner:

- Month of sale 30%

- Month following the sale 70%

40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.

Labour costs are 20% of sales. Other operating costs are $15,000 per month (including $4,000 of depreciation) . Both of these are paid in the month incurred. The cash balance on March 1 is $4,000. A minimum cash balance of $3,000 is required at the end of the month. Money can be borrowed in multiples of $1,000.

-How much cash will be collected from customers in March?

Definitions:

Mutual Funds

Mutual funds are investment vehicles that pool money from numerous investors to purchase a diversified portfolio of stocks, bonds, or other securities.

U.S. Treasury Bonds

Long-term debt securities issued by the United States Department of the Treasury with a maturity of more than ten years.

Equity Mutual Fund

A corporation that pools the funds of investors, including small investors, and uses them to purchase a bundle of stocks.

Q47: Clean Air is a manufacturer of dust

Q57: DataSave is a manufacturer of USB Flash

Q63: Which of the following condition(s) favours using

Q85: A computer chip is purchased to be

Q124: Which of the following would be shown

Q163: The overhead cost per Harrow using the

Q206: What is the direct materials efficiency variance

Q227: What is the contribution margin ratio for

Q241: SnoGo, Inc., produces ergonometric tool used for

Q256: Roadrunner Manufacturing produces Item Q with variable