Use the information below to answer the following question(s) :

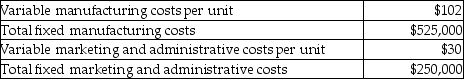

The following information relates to current production of bench seats for boats at Aquamarine Manufacturing:

The regular selling price per bench seat is $200. The company has the capacity to produce 15,000 bench seats per year, but is currently producing and selling 10,000 bench seats per year.

-Aquamarine Manufacturing is analyzing the opportunity to accept a special sales order for 3,000 bench seats at a price of $175 per unit. Fixed costs would remain unchanged. Regular sales will not be affected by the special order. If the company were to accept this special order, how would operating income be affected?

Definitions:

Direct Materials

are raw materials that can be directly attributed to the production process of a specific product, such as wood for furniture or metal for cars.

Break-even Points

The level of production or sales at which total revenues equal total expenses, resulting in no net profit or loss.

Common Fixed Expenses

These are fixed costs that do not vary with the volume of production or sales, such as utilities, rent, or administrative salaries, shared across different products or departments.

Variable Costing

An accounting method that considers only variable costs as product costs and treats fixed costs as period costs to be charged in full against the current period's revenue.

Q27: Atwood Lake Boats has budgeted sales for

Q58: At Deutschland Electronics, product lines are charged

Q73: When a company uses direct materials, the

Q92: The Schmidt Corporation has in its inventory

Q112: What is the standard direct material amount

Q156: At Cooper's Bags the plantwide manufacturing overhead

Q164: What is the cost per driver unit

Q215: For a product, revenue at market price

Q250: What is the direct manufacturing labour rate

Q269: Aquamarine Manufacturing is analyzing the opportunity to