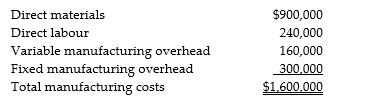

Hidef Electronics manufactures a digital flat screen TV which includes an MP3 player. Its current costs of manufacturing the needed 100,000 MP3 players per month are:

Another manufacturer offers to sell Hidef the needed 100,000 MP3 players per month for $13 per unit on as flexible a delivery schedule as Hidef wants. Hidef expects to reduce fixed overhead by $50,000 per month if MP3 players are purchased from the outside supplier. If the MP3 players are purchased Hidef will pay $0.50 per unit to transport the MP3 players to its manufacturing plant, where it will add its own logo at a cost of $0.10 per player.

No alternative use is available for the unused capacity if MP3 payers are purchased rather than manufactured. Prepare an analysis to show whether Hidef should make or buy the MP3 players.

Definitions:

Double-Declining-Balance Method

An accelerated depreciation method that expenses more of an asset’s cost closer to the beginning of its usable life.

Depreciable Asset Accounting

The accounting process that involves allocating the cost of a tangible asset over its useful life.

Depreciation Expense

The portion of the total cost of a depreciable asset that is allocated as an expense to the income statement in a given period.

Residual Value

The estimated value of a leased asset at the end of the lease term, or the expected value of an asset after its useful life ends.

Q12: Which of the following best describes "contribution

Q27: The "total costs to account for" is

Q62: If the Mountaintop golf course is a

Q83: Management uses budgeting to express its plans

Q118: The Assembly Department of Zedco Ltd. had

Q122: TK Electronics is a manufacturer with two

Q131: When deciding whether to drop a product,

Q144: What is the total cost of packaging

Q146: Dudley & Spahr, Attorneys at Law, provide

Q225: Companies often consider outsourcing so they can