Speedy Machine Products manufactures its products in two separate departments, Machining and Painting. Total manufacturing overhead costs for the year are budgeted at $2,500,000. Of this amount the Machining Department incurs $1,500,000 (primarily for machine operation and depreciation) while the Painting Department incurs $1,000,000. Speedy Machine Products estimates that it will incur 12,000 machines hours (all in the Milling Department) and 40,000 direct labour hours (15,000 in the Milling Department and 25,000 in the Assembly Department) during the year.

Speedy Machine Products currently uses a plantwide overhead rate based on direct labour hours to allocate overhead. However, the company is considering refining its overhead allocation system by using departmental overhead rates. The Machining Department would allocate its overhead using machine hours (MH), but the Painting Department would allocate its overhead using direct labour (DL) hours.

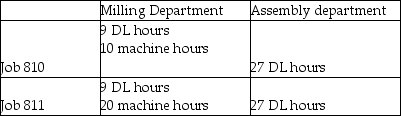

The following chart shows the machine hours (MH) and direct labour (DL) hours incurred by Jobs 810 and 811 in each production department:

Both Jobs 810 and 811 used $7,500 of direct materials. Wages and benefits total $30 per direct labour hour. Speedy Machine Products prices its products at 120% of total manufacturing costs.

Required:

1. Compute Speedy Machine Products' current plantwide overhead rate.

2. Compute refined departmental overhead rates.

3. Compute the total amount of overhead allocated to each job if Speedy Machine Products uses its current plantwide overhead rate.

4. Compute the total amount of overhead allocated to each job if Speedy Machine Products uses departmental overhead rates.

5. Do both allocation systems accurately reflect the resources that each job used? Explain.

6. Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' current plantwide overhead rate.

7. Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' refined departmental overhead rates

8. Based on the current (plantwide) allocation system, how much profit did Speedy Machine Products think it earned on each job?

9.Based on the departmental overhead rates and the sales price determined in Requirement 7, how much profit did it really earn on each job?

Definitions:

Cerebral Palsy

A neurological disorder caused by a non-progressive brain injury or malformation that occurs while the child’s brain is under development, affecting body movement and muscle coordination.

Homosexual Behavior

Sexual or romantic activities involving individuals of the same sex.

Natural

Occurring in or derived from nature; not made or caused by humankind.

Species

A category of living organisms consisting of similar individuals capable of exchanging genes or interbreeding.

Q29: What are the two basic types of

Q75: Clucker Chicken produces several styles of precooked

Q130: Big-box retailers such as Best Buy are

Q171: At Green Bags Company the plantwide manufacturing

Q186: When units are moved from one processing

Q210: The Assembly Department of Zoom Auto Parts

Q217: If a product line is being evaluated

Q221: June sales were $5,000 while projected sales

Q264: A company manufactures organic juices. Last month's

Q347: Manufacturing overhead costs can be directly traced