Use the information below to answer the following question(s) :

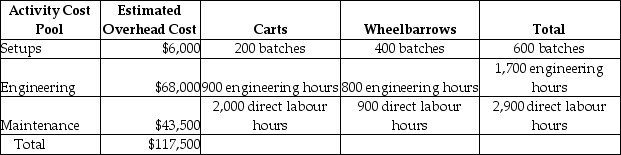

Vittoria Corporation manufactures two products-Carts and Wheelbarrows. The annual production and sales of Carts is 2,000 units, while 1,800 units of Wheelbarrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Carts require 1.0 direct labour hours per unit, while Wheelbarrows require 0.5 direct labour hours per unit. The total estimated overhead for the period is $117,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The overhead cost per Wheelbarrow using the traditional costing system would be closest to

Definitions:

Effective Price Floor

A government-imposed price control above the equilibrium price, intended to ensure producers receive a minimum price higher than what the market would naturally dictate.

Surplus

A scenario in which the supply of a particular good or service surpasses its demand at the existing market price.

Price Controls

Government-imposed limits on the prices that can be charged for goods and services in the market.

Rental Housing Market

The segment of the real estate market that involves the leasing or renting of property for residential purposes.

Q10: The estimated total manufacturing overhead costs that

Q70: Alsation Ltd. has two divisions:. The Machining

Q107: How much cash will be collected from

Q147: The plantwide overhead cost allocation rate is

Q173: If Sable Company uses direct labour cost

Q174: Waste activities is another name for value-added

Q234: A production schedule indicates the quantity and

Q255: What are the total equivalent units for

Q270: On December 31, what are the total

Q272: An equal amount of manufacturing overhead should