Use the information below to answer the following question(s) :

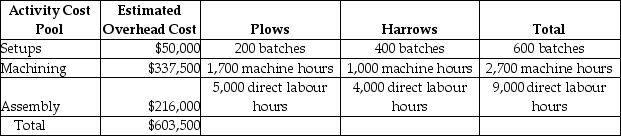

Martin Corporation manufactures two products-Plows and Harrows. The annual production and sales of Plows is 1,000 units, while 2,000 units of Harrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Plows require 5.0 direct labour hours per unit, while Harrows require 2.0 direct labour hours per unit. The total estimated overhead for the period is $603,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The predetermined overhead allocation rate using the traditional costing system would be closest to

Definitions:

Q16: At Pizza Company the cost per equivalent

Q112: Dymo Manufacturing has two departments that produce

Q114: What is the total cost assigned to

Q130: What was the total cost of Job

Q176: If the Green Pastures golf course is

Q200: What are the total equivalent units for

Q212: At the end of the year, what

Q253: Steins' Dairy processes 4,000 hectolitres (hL) of

Q271: Process costing is a useful system for

Q283: At Pizza Company the total cost of