Cindy Ho,VP of Finance at Discrete Components,Inc = 001,the Appropriate Decision Is _________

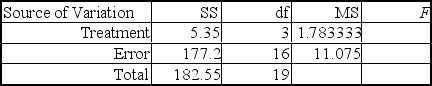

Cindy Ho,VP of Finance at Discrete Components,Inc.(DCI) ,theorizes that the discount level offered to credit customers affects the average collection period on credit sales. Accordingly,she has designed an experiment to test her theory using four sales discount rates (0%,2%,4%,and 6%) by randomly assigning five customers to each sales discount rate.An analysis of Cindy's data produced the following ANOVA table.

Using = 0.01,the appropriate decision is _________.

Definitions:

Donations

Voluntary transfers of assets, including cash, goods, or services to another party without directly receiving something of equal value.

Endowment Contribution

A donation made to an organization with the stipulation that the funds are to be invested and the principal remained intact.

Restricted Fund Method

An accounting principle that mandates funds designated for a specific purpose by a donor must be tracked and reported separately from general funds.

Deferred Revenue

Revenue received by a company for goods or services to be delivered in the future, recognized as a liability until the service or product is provided.

Q6: In a regression analysis if SST =

Q24: The head of the math department at

Q28: A study is going to be conducted

Q42: In regression analysis,outliers may be identified by

Q44: A multiple regression analysis produced the following

Q60: Suppose a researcher is interested in understanding

Q63: Abby Kratz,a market specialist at the market

Q66: A researcher wants to estimate the proportion

Q85: Collinsville Construction Company purchases steel rods

Q88: A multiple regression analysis produced the following