Ballantine Company Manufactures Two Products Because the Industrial Product Is Twice as Profitable as the System

Ballantine Company manufactures two products.Currently,the company uses a traditional costing system assigning overhead based on direct labor hours.The Industrial product is more complex to produce,requiring two hours of direct labor time per unit,compared to one hour of direct labor time for the Consumer product.Given the company's total overhead costs of $720,000 and production of 1,000 Industrials and 8,000 Consumers,this results in an overhead allocation rate of $72 per direct labor hour.The following unit data are provided:

Because the Industrial product is twice as profitable as the Consumer model,the sales manager wants to reduce or eliminate production of the Consumer product and devote as much capacity as possible to the Industrial product.

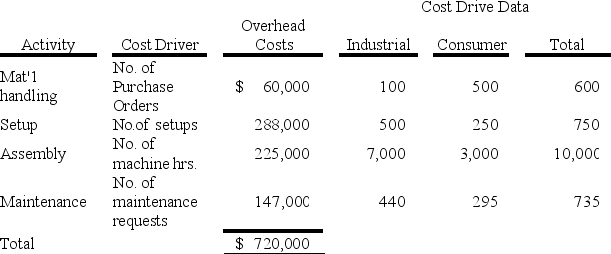

You are worried that the current cost accounting system may be providing inaccurate results and would like to implement an ABC system.Assume that the company's overhead costs were traced to four major activities.The amount of overhead costs traceable to each activity for the current year is provided below:

Required:

Required:

1)Compute the four activity rates that will be used to assign overhead to the products under activity-based costing:

2)Compute the amount of overhead cost which should be assigned to Industrials and Consumers under activity-based costing.Also compute the overhead cost per unit for each product.

3)Compute the total cost to manufacture one unit of each product if activity-based costing is used.

4)Respond to the sales manager's recommendation that capacity be diverted from Consumers to Industrials.

Definitions:

Commission

A payment made to an employee or agent based on the value of the sale completed, often a percentage of the sale amount.

Principals

The original amount of money invested or loaned, not including interest or earnings.

Net Proceeds

The amount sent to the consignor as a result of consignment sales; gross proceeds minus charges.

Commission

A fee or percentage given to a salesperson, agent, or broker for facilitating or completing a sale or transaction.

Q22: Select the correct statement regarding activity-based costing

Q33: Sentra Sporting Company sells tennis rackets

Q37: Greenhill Company's balance sheet as of

Q65: Select the correct statement regarding relevant revenues.<br>A)

Q83: Based on the income statements of

Q89: At the beginning of the period,Cambridge

Q111: Michael & Co.expects overhead costs of

Q113: Sentra Sporting Company sells tennis rackets

Q113: Select the incorrect statement regarding the relationship

Q152: Chavez Company is considering purchasing new