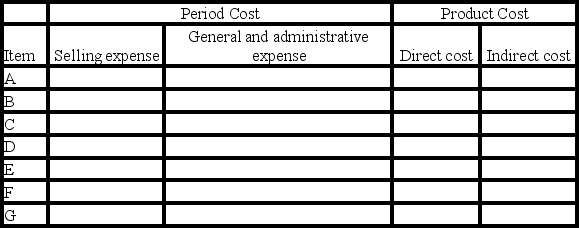

Classify each of the following costs for Harrison Company as a selling or general and administrative period cost or as a direct or indirect product cost by entering the dollar amount(s)in the appropriate column(s):

A.Paid $75,000 in wages for employees who assemble the company's products.

B.Paid sales commissions of $58,000.

C.Paid $38,000 in salaries for factory supervisors.

D.Paid $88,000 in salaries for executives (president and vice presidents).

E.Recorded depreciation cost of $25,000.$13,000 was depreciation on factory equipment and $12,000 was depreciation on the company headquarters building.

F.Paid $4,000 for various supplies that it used in the factory (oil and materials used in machine maintenance).

G.Used $10,000 in prepaid corporate liability insurance.

Definitions:

Corporate Tax Rate

The percentage of a corporation's income that it pays as taxes to the government.

CCA Class

Refers to the Canadian Classification of Capital Assets, a system used in Canada for categorizing fixed assets for tax depreciation purposes.

Q2: The market supply curve for a good

Q5: When the price of beef rises,the demand

Q14: Economists sometimes say that wants are "unlimited"

Q24: The organization of productive activities among persons

Q49: At its $60 selling price,Atlantic Company has

Q109: A low magnitude of operating leverage is

Q119: What is operating leverage,and how does a

Q120: Beacon Company makes a product that has

Q133: Adams Company sells a product whose contribution

Q163: When the price of a good falls,there