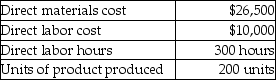

Gill Manufacturing uses a predetermined overhead allocation rate based on a percentage of direct labor cost.At the beginning of the year,Gill estimated total manufacturing overhead costs at $1,050,000 and total direct labor costs at $820,000.In June,Gill completed Job 511.The details of Job 511 are shown below.(Round to 2 decimal places. )

How much was the total job cost of Job 511? (Round any percentages to two decimal places and your final answer to the nearest dollar. )

Definitions:

Profit Margin

A financial metric used to assess a firm's financial health by revealing the percentage of money earned as profit.

Premium Price

Pricing goods or services higher than the market average to reflect their perceived extra value or quality.

Revenue Driver

Key factors or activities that significantly influence or contribute to the generation of income for a business.

Presales Costs

Expenses incurred during the preliminary phase of a sales process, such as market research, product development, and pitch preparation, before actual sales begin.

Q1: Kumar produces large decorative tiles used in

Q3: Managerial accounting reporting by a public firm

Q4: Iglesias,Inc.completed Job 12 on November 30.The details

Q14: Irene Manufacturing uses a predetermined overhead allocation

Q56: Bacon Financial Advisors provides accounting and finance

Q91: Variable costing is used for external reporting

Q127: The profit margin ratio _.<br>A)focuses on the

Q157: An increase in selling price per unit

Q165: The fixed costs per unit will _.<br>A)increase

Q177: When the total variable costs are deducted