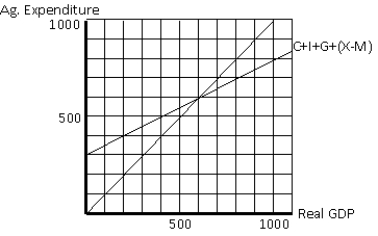

Exhibit 12-2

-In an economy characterized by the aggregate expenditure line in Exhibit 12-2, how would a $100 increase in autonomous net taxes impact real GDP?

Definitions:

Job-Order Costing

An accounting method that tracks production costs to specific jobs or orders, allowing for detailed cost analysis of each job.

Predetermined Overhead Rate

A rate calculated by dividing estimated overhead costs by an allocation base, used to allocate overhead costs to products or services.

Direct Labor-Hours

A measure of the total hours worked by employees directly involved in manufacturing a product or providing a service.

Manufacturing Overhead

Manufacturing overhead encompasses all production costs other than direct materials and direct labor, including expenses like factory equipment maintenance and utilities.

Q1: The U.S. government's fiscal year covers from<br>A)January

Q5: A drop in stock prices will _

Q25: Net taxes are<br>A)taxes plus transfer payments<br>B)taxes minus

Q102: If the economy is already at its

Q146: In an economy characterized by the aggregate

Q166: When the economy is at its potential

Q172: An rise in stock prices will _

Q187: Permanent income is income individuals expect to

Q188: The various output levels produced at different

Q204: If two kinds of money are circulating