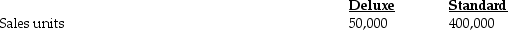

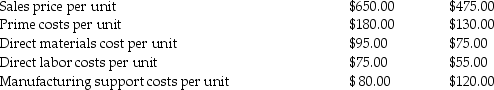

Luzent Company produces two types of entry doors: Deluxe and Standard.The assignment basis for support costs has been direct labor dollars.For 2018,Luzent compiled the following data for the two products:

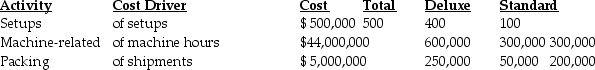

Last year,Luzent Manufacturing purchased an expensive robotics system to allow for more decorative door products in the deluxe product line.The CFO suggested that an ABC analysis could be valuable to help evaluate a product mix and promotion strategy for the next sales campaign.She obtained the following ABC information for 2018:

Required:

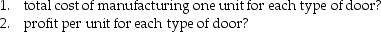

a.Using the current system,what is the estimated

b.Using the current system,estimated manufacturing overhead costs per unit are less for the deluxe door ($80 per unit)than the standard door ($120 per unit).What is a likely explanation for this?

c."ABC systems may result in misallocation of indirect costs." Do you agree? Give reasons for your answer.

d.What considerations need to be examined when determining a sales mix strategy?

e.While implementing an ABC system for the first time,achieving a significant change overnight is difficult and this may de motivate employees.How can managers overcome this problem?

Definitions:

Weighted-Average Method

An inventory costing method that calculates the cost of goods sold based on the average cost of all items available for sale during the period.

Cost Reconciliation

Cost reconciliation is the process of analyzing and adjusting the differences between the actual costs incurred and the standard or budgeted costs to understand variances in manufacturing or production activities.

Process Costing

Process costing is a method of costing used by companies that produce similar or homogenous products, where costs are accumulated over a period and then allocated to units of product.

Weighted-Average Method

An inventory costing method that assigns an average cost to each unit of inventory, calculated by dividing the total cost of goods available for sale by the total units available.

Q1: In the cash budget,the total cash available

Q28: Oil refining companies primarily use job costing

Q56: It is appropriate for service organizations such

Q93: Explain how the following statement be true:

Q116: Grounds-maintenance costs incurred during the summer months

Q147: A budgeted indirect-cost rate is computed for

Q149: Contribution margin equals _.<br>A)revenues minus period costs<br>B)revenues

Q164: Columbus Company provides the following ABC costing

Q201: Which of the following departments is most

Q208: Assume the following cost information for Fernandez