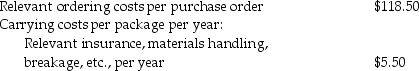

Globe Inc.is a distributor of DVDs.DVD Mart is a local retail outlet which sells blank and recorded DVDs.DVD Mart purchases DVDs from Globe at $30.00 per DVD;DVDs are shipped in packages of 66.Globe pays all incoming freight,and DVD Mart does not inspect the DVDs due to Globe's reputation for high quality.Annual demand is 312,000 DVDs at a rate of 6500 DVDs per week.DVD Mart earns 10% on its cash investments.The purchase-order lead time is one week.The following cost data are available:

How many deliveries will be made during each time period?

Definitions:

Risk Premium

The extra return above the risk-free rate that investors require to compensate them for holding a risky asset.

Bearing Risk

The act of accepting potential loss from uncertainty in investment or business operations.

Unexpected Returns

Returns on an investment that exceed what is predicted by models or expected based on historical trends, often caused by unforeseen factors or events.

Expected Returns

The anticipated amount of profit or loss an investor predicts to receive from an investment, taking into account the possibility of fluctuating values.

Q9: The AARR method is similar to the

Q28: Depreciation results in income tax cash savings

Q38: Sharing sales information throughout the supply chain

Q40: Stock options give executives the right to

Q74: Management control systems should be designed to

Q102: All inventory costs are available in financial

Q120: Moto Corp allows its divisions to operate

Q125: What is decentralization and what are its

Q130: Craylon Corp has three divisions,which operate autonomously.Their

Q137: Budgeted costs are _.<br>A)the costs incurred this