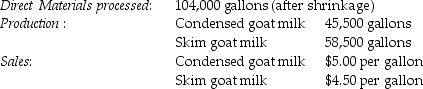

The Green Company processes unprocessed goat milk up to the split-off point where two products,condensed goat milk and skim goat milk result.The following information was collected for the month of October:

The costs of purchasing the of unprocessed goat milk and processing it up to the split-off point to yield a total of 104,000 gallons of saleable product was $186,480.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 45,000 gallons (the remainder is shrinkage) of a medicinal milk product,Xyla,for an additional processing cost of $4 per usable gallon.Xyla can be sold for $19 per gallon.

Skim goat milk can be processed further to yield 57,200 gallons of skim goat ice cream,for an additional processing cost per usable gallon of $4.The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

Using estimated net realizable value,what amount of the joint costs would be allocated Xyla and the skim goat ice cream? (Round intermediary percentage calculations to the nearest hundredth. )

Definitions:

Apps

Short for applications, software programs designed to perform specific tasks or functions on a computer or mobile device.

Digital Literacy

The ability to effectively find, use, and create information or content using digital technologies.

Mobile Devices

Portable electronic devices with computing capabilities, including smartphones and tablets, often used for communication, entertainment, and accessing the internet.

Computerized Animation Techniques

Methods and processes used in the creation of animated sequences or images through digital software and computer technology.

Q4: The sales-mix variance will be favorable when

Q4: Percentage of reworked products is an example

Q4: The Swivel Chair Company manufacturers a standard

Q9: Manufacturing lead time is the sum of

Q26: Companies calculate the units of abnormal spoilage

Q66: Tony placed an order for a customized

Q71: Prevention costs include inspection and product testing.

Q73: Managers find operation costing useful in cost

Q95: The constant gross-margin percentage method differs from

Q113: The single cost-allocation method makes no distinction