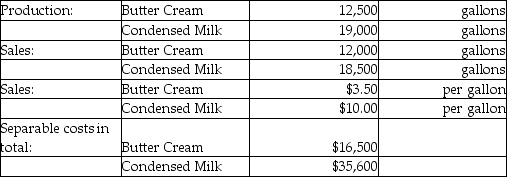

The Brital Company processes unprocessed milk to produce two products,Butter Cream and Condensed Milk.The following information was collected for the month of June:

The costs of purchasing the of unprocessed milk and processing it up to the split-off point to yield a total of 31,500 gallons of saleable product was $109,025.

The company uses constant gross-margin percentage NRV method to allocate the joint costs of production.If separable costs of Butter Cream was $19,000 and constant gross margin was 30%,what would have been the total allocated joint costs of production?

Definitions:

Income Tax Expense

The cost incurred by businesses and individuals related to the taxes on their income, reflecting the amount of income tax that a company is obligated to pay to tax authorities.

Incremental Net Cash

The difference in net cash flows between two alternatives, emphasizing the additional cash brought in by a certain decision.

Tax Rate

The percentage at which an individual or corporation is taxed.

Incremental Net Income

The increase in net income resulting from a particular business decision or activity, compared to what it would have been without that decision or activity.

Q3: Which of the following correctly describes manufacturing

Q5: The Laramie Factory produces expensive boots.It has

Q21: Revenue allocation is required to determine the

Q22: Which of the following is a storage

Q64: Charlie Chairs Inc. ,manufactures plastic moldings for

Q66: The Kenton Company processes unprocessed milk to

Q76: You are the chief financial officer of

Q80: Which of the following is an advantage

Q99: Acme Janitor Service has always taken pride

Q134: Electro Corp sells a refrigerator and a