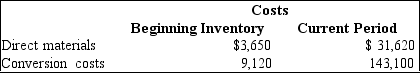

The Bakersfield Company has the following information available:  At the beginning of the period, there were 800 units in process that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. During the current period, 5,800 units were started and completed. Ending inventory contained 400 units that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. (Assume that the company uses the FIFO process costing method.)

At the beginning of the period, there were 800 units in process that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. During the current period, 5,800 units were started and completed. Ending inventory contained 400 units that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. (Assume that the company uses the FIFO process costing method.)

The equivalent units of production for direct materials and conversion costs, respectively, were

Definitions:

Operating Activities

Transactions and events related to the core business functions, including revenue and expense activities that affect net income on the income statement.

Direct Method

A method for creating the cash flow statement by directly listing the actual cash flows associated with operating activities.

Operating Activities

Business actions that are involved in the day-to-day functions of producing goods, offering services, and other core operations.

Direct Method

A way of allocating service department costs directly to production departments without any consideration for services rendered between service departments.

Q6: A process costing system is used by

Q11: In a job order costing system, the

Q23: If a partnership agreement does not specify

Q27: The graphical approach to cost-volume-profit analysis generally

Q36: Management accounting is not a subordinate activity

Q56: Similar to financial accounting reports, management accounting

Q57: When a loss is closed into the

Q73: During March, Department A started 300,000 units

Q89: Lopar Company uses a predetermined overhead rate

Q99: The fathers of the balanced scorecard, Drs.