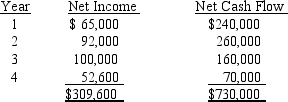

June Co.is evaluating a project requiring a capital expenditure of $619,200.The project has an estimated life of four years and no salvage value.The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%.The present value of $1 at compound interest of 12% for 1,2,3,and 4 years is .893,.797,.712,and .636,respectively.

Determine: (a)the average rate of return on investment,giving effect to depreciation on the investment,and (b)the net present value.

Definitions:

Current Liabilities

Debts or obligations that a company is expected to pay within one year, including accounts payable, short-term loans, and accrued expenses.

Accounts Payable

Liabilities of a business that are due to suppliers for goods and services bought on credit, to be paid off within a short period.

Financial Statement Analysis

This is the process of reviewing and evaluating a company's financial statements to make business decisions.

Balance Sheet

A financial statement that summarizes a company's assets, liabilities, and shareholders' equity at a specific point in time.

Q5: Which method of evaluating capital investment proposals

Q30: A mutant strain of E.coli lacks a

Q32: The cash budget summarizes future plans for

Q34: What category of reaction converts orotate monophosphate

Q38: The sequence steps involved in elongation of

Q38: Which of the following correctly describes

Q46: Which of the following best describes the

Q48: The sales,income from operations,and invested assets for

Q93: An unfavorable volume variance may be due

Q114: Budgetary slack can be avoided if lower