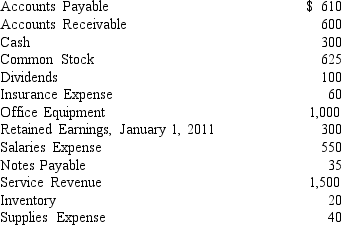

Following are the financial statement data for Yevin Temporary Services at December 31,2011.Prepare Yevin's income statement.

Definitions:

Depreciation Expense

An accounting method to allocate the cost of a tangible or physical asset over its useful life.

Net Income

The total profit of a company after all expenses and taxes have been subtracted from total revenue; often called the bottom line.

Marginal Rate

The rate at which one additional unit of a variable is accounted for in the cost-benefit analysis, commonly used in the context of taxation and production.

Tax Rate

The fraction of income or profits that an individual or company needs to pay to the government as tax.

Q5: The USERRA legislation provided the following:<br>A)Military service

Q10: Merchandising businesses must be corporations.

Q20: Besides containing the supporting data for periodic

Q38: Based on the information below,illustrate the effects

Q49: Inventory NOT sold at the end of

Q51: Warren is a married employee with six

Q52: Which of the following items must exist

Q96: When are sales recognized under the cash

Q102: The bank statement for Marley Co.indicates a

Q134: When merchandise is purchased to resell to