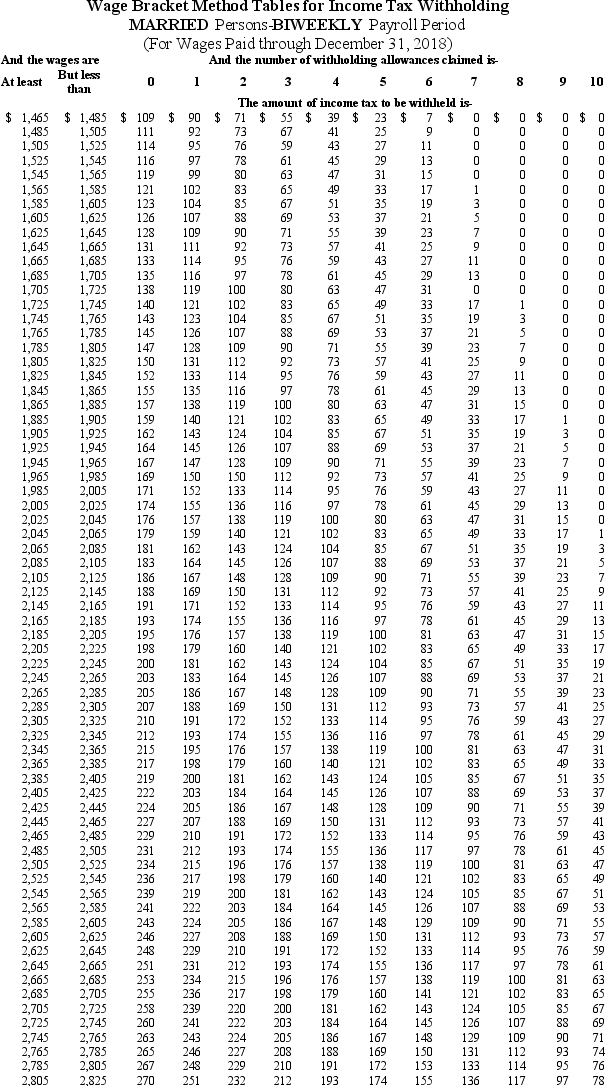

Vivienne is a full-time exempt employee in DeKalb County,Indiana,and is paid biweekly.She earns $39,000 annually,and is married with 2 withholding allowances.Her state income tax deduction is $44.46,and the DeKalb County income tax deduction is $19.62.What is the total amount of her FICA,federal,state,and local taxes per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine the federal tax deduction.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

Definitions:

Mission Statement

A concise statement that defines the goals, ethics, culture, and fundamental purpose of an organization or company.

Diversification Analysis Matrix

A tool used in strategic management and planning to evaluate the degree of diversification within a company's portfolio of businesses or products.

Market-Product Strategies

Approaches that define how a company's products or services will be offered to meet the needs of specific market segments.

Market Share

The share of overall sales within an industry or market that a certain company acquires over a determined period.

Q3: Which of the following columns would be

Q3: Why do different methods of time collection

Q6: Daigneault Designs has the following amounts listed

Q32: To arrive at cash flows from operations,it

Q43: What does the term "billable time" mean

Q45: What payroll-specific tool is used to facilitate

Q61: Cyrus is a tipped employee in Illinois.He

Q66: In which order are transactions listed in

Q72: The _ prohibited discrimination based on race,creed,color,gender,or

Q94: Accounts receivable arising from trade transactions amounted