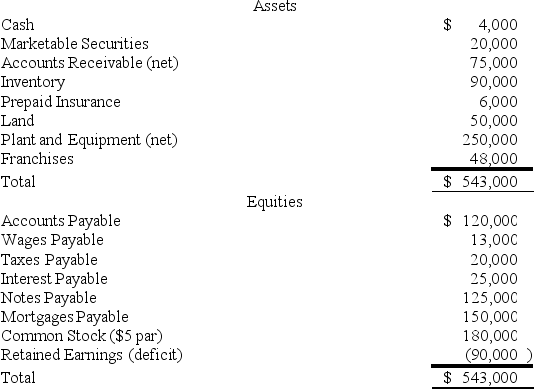

Wilbur Corporation is to be liquidated under Chapter 7 of the Bankruptcy Code.The balance sheet on December 31,20X8,is as follows:

The following additional information is available:

1.Marketable securities consist of 2,000 shares of Bristol Inc.common stock.The market value per share of the stock is $8.The stock was pledged against a $20,000,8 percent note payable that has accrued interest of $800.

2.Accounts receivable of $40,000 are collateral for a $35,000,10 percent note payable that has accrued interest of $3,500.

3.Inventory with a book value of $35,000 and a current value of $32,000 is pledged against accounts payable of $60,000.The appraised value of the remainder of the inventory is $50,000.

4.Only $1,000 will be recovered from prepaid insurance.

5.Land is appraised at $65,000 and plant and equipment at $160,000.

6.It is estimated that the franchises can be sold for $15,000.

7.All the wages payable qualify for priority.

8.The mortgages are on the land and on a building with a book value of $110,000 and an appraised value of $100,000.The accrued interest on the mortgages is $7,500.

9.Estimated legal and accounting fees for the liquidation are $10,000.

Required:

a.Prepare a statement of affairs as of December 31,20X8.

b.Compute the estimated percentage settlement to unsecured creditors.

Definitions:

Vesicles

Small holes found in a volcanic rock, representing gas bubbles in a magma that were trapped when the lava solidified.

Welded Tuff

A type of rock formed by the compaction and cementation of volcanic ash and debris, heated enough post-deposition to weld together.

Scoria

A dark gray, black, or reddish volcanic rock that contains abundant vesicles, usually having the composition of basalt or andesite; synonymous with volcanic cinders.

Basalt

A dark, fine-grained volcanic rock formed from the rapid cooling of magnesium- and iron-rich lava, characteristic of oceanic crust.

Q15: Under the modified accrual basis of accounting

Q24: The following are the income statements of

Q36: The gross margin method of estimating inventory

Q37: A tax collection fund that collects property

Q37: Refer to the information given above.What amount

Q62: Generally accepted accounting principles require that a

Q62: Liabilities are reported on which of the

Q71: Transaction: Received contributions restricted by donors for

Q74: On January 1,20X1,Washington City received $200,000 from

Q106: On June 30,20X9,a voluntary health and welfare