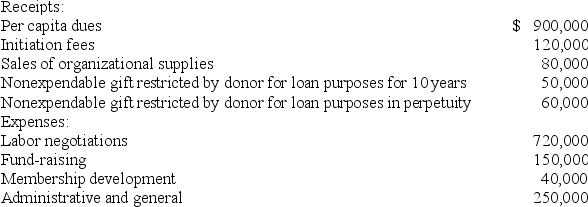

Golden Path,a labor union,had the following receipts and expenses for the year ended December 31,20X8:

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

-Based on the information provided,in Golden Path's statement of activities for the year ended December 31,20X8,what amount should be reported under the classification of revenue from funds without donor restrictions?

Definitions:

Journal

A detailed record where all financial transactions of a business are initially recorded before being transferred to accounts in the ledger.

Chart of Accounts

A systematic list of all account titles and numbers used by a company to organize its financial transactions and prepare financial statements.

Debits

Accounting entries that increase asset or expense accounts, or decrease liability, equity, or revenue accounts; they are recorded on the left side of accounting ledgers.

Credits

Accounting entries that increase liabilities or equity or that decrease assets.

Q6: What is the amount of total assets

Q12: On a partner's personal statement of changes

Q19: Trimester Corporation's revenue for the year ended

Q22: The Canadian subsidiary of a U.S.company reported

Q38: A transaction has been recorded in the

Q47: Seattle,Inc.owns an 80 percent interest in a

Q47: JCS Incorporated experienced the following transactions during

Q63: A voluntary health and welfare organization received

Q72: What was the amount of retained earnings

Q87: Which of the following statements about the