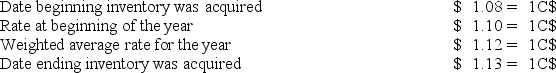

The Canadian subsidiary of a U.S.company reported cost of goods sold of 50,000 C$,for the current year ended December 31.The beginning inventory was 15,000 C$,and the ending inventory was 10,000 C$.Spot rates for various dates are as follows:

Assuming the Canadian dollar is the functional currency of the Canadian subsidiary,the translated amount of cost of goods sold that should appear in the consolidated income statement is

Definitions:

Cross-Cultural Analysis

The examination of how cultural variables influence human behavior, practices, and ways of thinking across different societies.

Joint Venture

A partnership where at least two entities contribute their resources to complete a designated project.

Direct Investment

The purchase or establishment of a controlling interest in foreign businesses by a company or individual, often involving significant ownership of a stake or property.

Scanning

The process of analyzing the environment to identify changes or trends that may affect an organization's future.

Q4: Infinity Corporation acquired 80 percent of the

Q11: Based on the preceding information,what is the

Q13: Based on the information given above,what will

Q15: Based on the information provided,what amount of

Q29: Agency funds report:<br>A)only assets and liabilities.<br>B)assets,liabilities,fund balance,revenues,and

Q35: Which of the following is defined as

Q42: When a partnership is formed,noncash assets contributed

Q45: Schedule 13D is filed:<br>A)by entities that acquire

Q47: If 1 British pound can be exchanged

Q62: The disclosure,"net assets released from restrictions," is