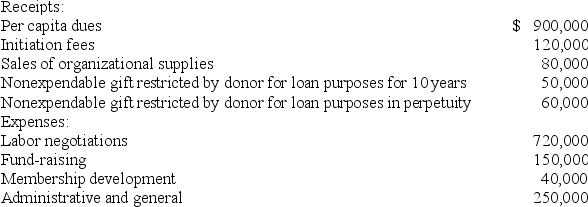

Golden Path,a labor union,had the following receipts and expenses for the year ended December 31,20X8:

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

-Based on the information provided,in Golden Path's statement of activities for the year ended December 31,20X8,what amount should be reported under the classification of program services?

Definitions:

Credit Card

A payment card issued to users as a method of payment allowing the cardholder to pay for goods and services based on the holder's promise to pay for them.

Journal Entry

A record in the books of accounts that shows a business transaction and its effect on the company's finances.

Percent of Receivables Method

An accounting method used to estimate the amount of accounts receivable that will not be collected by calculating a percentage of receivables deemed uncollectible.

Uncollectible Accounts Receivable

Accounts from customers that are considered unrecoverable, leading to a write-off as a bad debt expense.

Q5: Which of the following funds are classified

Q7: Proxy statements are:<br>A)filed by an entity that

Q10: Refer to the above information.Assuming the U.S.dollar

Q14: The DEF partnership reported net income of

Q20: In the computation of a partner's Loss

Q22: Which of the following financial statements is

Q36: Which of the following accounts would not

Q41: Chicago based Corporation X has a number

Q58: Partner A has a smaller capital balance

Q101: Based on common-sized income statements,which of the