On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

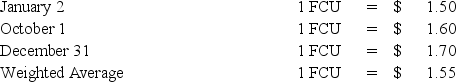

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the balance in Polaris's investment in foreign subsidiary account at December 31,2008?

Definitions:

Developmental Screening

Assessments used to identify children who may have delays in their developmental milestones and need further evaluation.

Quantitative Changes

Modifications that can be measured and expressed in numerical terms, often used in reference to growth, development, or alterations in entities.

Growth

The process of increasing in physical size, or the development and progress in personal abilities, knowledge, and skills.

Development

The process of growth or progression through a series of changes, often leading to an improved or more complex form.

Q4: Consolidated financial statements are required by GAAP

Q8: Based on the preceding information,what amount would

Q20: Expended 75 percent of the contributions previously

Q24: Based on the information given above,what balance

Q27: Refer to the information provided above.David invests

Q32: Based on the preceding information,what amount of

Q33: Based on the information given above,by what

Q34: Based on the preceding information,what will be

Q35: Refer to the information provided above.How much

Q58: Based on the information given above,what amount