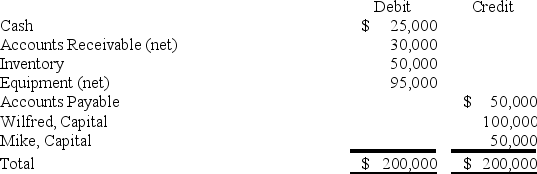

The trial balance of WM Partnership is as follows:

Wilfred and Mike decide to incorporate their partnership.The partnership's books will be closed,and new books will be used for W & M Corporation.The following additional information is available:

Wilfred and Mike decide to incorporate their partnership.The partnership's books will be closed,and new books will be used for W & M Corporation.The following additional information is available:

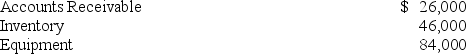

1.The estimated fair values of the assets follow:

2.All assets and liabilities are transferred to the corporation.

2.All assets and liabilities are transferred to the corporation.

3.The common stock is $10 par.Wilfred and Mike receive a total of 10,000 shares.

4.The partners share profits and losses in the ratio 7:3.

-Based on the preceding information,the journal entry on W & M Corporation's books to record the assets and the issuance of the common stock will include a credit to Additional Paid-In Capital for:

Definitions:

Productive Advantage

A situation where a person or entity can produce goods or services at a lower opportunity cost than others.

Opportunity Cost

The cost of forgoing the next best alternative when making a decision, representing the benefits one misses out on when choosing one option over another.

Bushel

A unit of volume that is used in the United States for measuring agricultural commodities, usually grains.

Bananas

A long, curved fruit with soft, pulpy flesh and yellow skin when ripe, commonly eaten as a staple food or snack.

Q1: Infinity Corporation acquired 80 percent of the

Q17: The Town of Baker reported the following

Q23: Which of the following accounts is not

Q33: What amount should be reported as expenditures

Q36: Refer to the information provided above.David invests

Q41: Simon Company has two foreign subsidiaries.One is

Q46: Based on the information provided,what amount will

Q47: The income tax expense applicable to the

Q52: The ABC partnership had net income of

Q54: Upon completion of construction and full payment