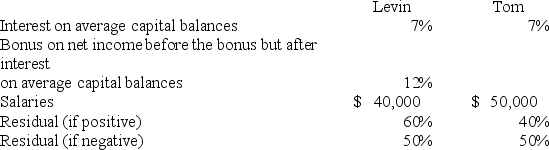

Net income for Levin-Tom partnership for 20X9 was $125,000.Levin and Tom have agreed to distribute partnership net income according to the following plan:

Additional Information for 20X9 follows:

1.Levin began the year with a capital balance of $75,000.

2.Tom began the year with a capital balance of $100,000.

3.On March 1,Levin invested an additional $25,000 into the partnership.

4.On October 1,Tom invested an additional $20,000 into the partnership.

5.Throughout 20X9,each partner withdrew $200 per week in anticipation of partnership net income.The partners agreed that these withdrawals are not to be included in the computation of average capital balances for purposes of income distributions.

Required:

a.Prepare a schedule that discloses the distribution of partnership net income for 20X9.Show supporting computations in good form.

b.Prepare the statement of partners' capital at December 31,20X9.

c.How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $45,000 to Levin and $60,000 to Tom?

Definitions:

Aldehydes

Organic compounds characterized by the presence of a carbonyl group bonded to at least one hydrogen atom, typically found at the end of a molecule.

Ketones

Organic compounds characterized by a carbonyl group (C=O) bonded to two carbon atoms, prominent in many biological and synthetic contexts.

Cyanohydrins

Organic compounds containing both a hydroxyl and a nitrile group, typically formed from aldehydes or ketones and hydrogen cyanide.

Cyclohexanone

An organic compound characterized by a six-membered cyclic structure containing one ketone group, used as a solvent and in the synthesis of various chemicals.

Q5: Based on the information given above,what price

Q6: Use the information given,but also assume that

Q8: Nichols Company owns 90% of the capital

Q13: Pratt Corporation acquired 90 percent of Splatt

Q19: Refer to the above information.Assuming Ski's FCU

Q23: Barcode Corporation acquired 70% of the common

Q29: Based on the preceding information,what is the

Q49: Government-wide financial statements prepared for a municipality

Q54: Assume that the replacement did not happen

Q89: What was the amount of liabilities on