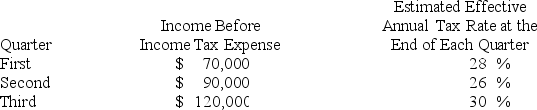

Chicago Company,a calendar-year corporation,had the following actual income before income tax expense and estimated effective annual income tax rates for the first three quarters in 20X2:

Chicago's income tax expense in its interim income statement for the third quarter should be:

Definitions:

Revenues

Income generated from normal business operations and other business activities.

Expenses

Costs incurred in the operation of a business that reduce profitability, such as rent, salaries, and utilities.

Fees Earned

Revenue generated from services provided or work done over a specific period.

Accounting Cycle

The process of recording and processing all financial transactions of a company, from when the transaction occurs, to its representation on the financial statements.

Q8: Based on the information given above,what amount

Q10: Based on the preceding information,what amount of

Q16: Quantum Company imports goods from different countries.Some

Q19: Norton Company recently petitioned for bankruptcy and

Q24: Based on the preceding information,what amount will

Q33: Refer to the above information.If the other

Q38: Tanner Company,a subsidiary acquired for cash,owned equipment

Q44: Net income for Levin-Tom partnership for 20X9

Q51: When there are intercompany sales of inventory

Q56: Based on the information provided,the beginning differential