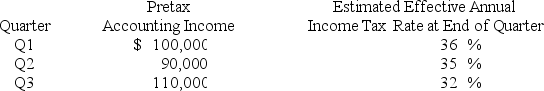

Daniel Corporation,which has a fiscal year ending December 31,had the following pretax accounting income and estimated effective annual income tax rates for the first three quarters of the year ended December 31,20X6:

Daniel's income tax expense in its interim income statement for the third quarter is:

Definitions:

Summary

A brief statement or account that presents the main points or highlights of a longer piece of content, document, or discussion.

Organizational Hierarchy

The arrangement of individuals within an organization in levels of importance or rank, often depicted in a pyramid structure.

Social Media

Digital platforms that enable users to create, share, and engage with content and participate in social networking.

Interpersonal Relationship

A connection between two or more people, based on social or emotional interactions, communication, and shared experiences.

Q11: All of the following are benefits the

Q29: Refer to the information provided above.David directly

Q34: Based on the information provided,the differential associated

Q36: The accounting statement of affairs is prepared:<br>A)at

Q37: Based on the preceding information,what was the

Q53: Estimated gross profit rates may be used

Q54: Which combination of accounts and exchange rates

Q55: Operand Corporation reported consolidated revenues of $30,000,000

Q68: When a new partner is admitted into

Q112: Refer to the above information.On the statement