On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

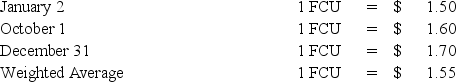

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the amount of patent amortization for 20X8 that results from Polaris's acquisition of Ski's stock on January 2,20X8?

Definitions:

Nash Equilibrium

Nash Equilibrium refers to a situation in a game theory model where no player can benefit by changing their strategy while the other players keep theirs unchanged.

Gains From Trade

The benefits that parties obtain from engaging in voluntary trade, allowing them to obtain goods or services they desire more than what they give up.

John Nash

An American mathematician known for his groundbreaking work in game theory, Nash Equilibrium, and his struggles with schizophrenia, depicted in the movie "A Beautiful Mind."

Bargaining Position

The relative power or advantage one party has to influence the terms of a negotiation.

Q3: Based on the preceding information,the elimination entry

Q4: Consolidated financial statements are required by GAAP

Q29: The general fund of the City of

Q33: For which of the following reporting units

Q43: Assume Push sold the inventory to Shove.Using

Q46: Which of the following acts helps businesses

Q48: Based on the information given above,what amount

Q53: Which accounts described below would have non-zero

Q57: Based on the information given above,what amount

Q108: Transaction: The governing board designated assets for