On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

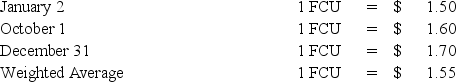

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the balance in Polaris's investment in foreign subsidiary account at December 31,2008?

Definitions:

Superbill

A form that combines the charges for services rendered, an invoice for payment or insurance copayment, and all the information for submitting an insurance claim; also known as an encounter form.

Procedure Codes

Standardized numeric or alphanumeric codes used to identify specific health care procedures for billing and documentation.

Services Rendered

The completed work or duties performed by someone, often referring to professional tasks.

Statement

A document or report summarizing transactions, balances, and other financial information for a specified time period.

Q1: Which of the following statements best describes

Q2: "Classification of investment income from endowment investments

Q3: Based on the preceding information,in the entry

Q18: Based on the preceding information,the investment elimination

Q20: Expended 75 percent of the contributions previously

Q27: Based on the preceding information,what is the

Q31: Based on the preceding information,on the statement

Q37: A tax collection fund that collects property

Q40: The following information pertains to property taxes

Q62: Refer to the above information.Which of the