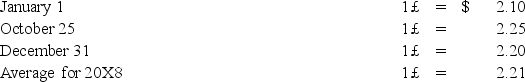

Michigan-based Leo Corporation acquired 100 percent of the common stock of a British company on January 1,20X8,for $1,100,000.The British subsidiary's net assets amounted to 500,000 pounds on the date of acquisition.On January 1,20X8,the book values of its identifiable assets and liabilities approximated their fair values.As a result of an analysis of functional currency indicators,Leo determined that the British pound was the functional currency.On December 31,20X8,the British subsidiary's adjusted trial balance,translated into U.S.dollars,contained $17,000 more debits than credits.The British subsidiary reported income of 33,000 pounds for 20X8 and paid a cash dividend of 8,000 pounds on October 25,20X8.Included on the British subsidiary's income statement was depreciation expense of 3,500 pounds.Leo uses the fully adjusted equity method of accounting for its investment in the British subsidiary and determined that goodwill in the first year had an impairment loss of 25 percent of its initial amount.Exchange rates at various dates during 20X8 follow:

-Based on the preceding information,the receipt of the dividend will result in a credit to the investment account for:

Definitions:

Cliched

Describing phrases or ideas that have been overused to the point of losing their original meaning or effectiveness.

Readability

Readability measures how easy it is for a reader to understand and comprehend written text, influenced by factors like sentence structure, choice of words, and layout.

Comprehension

The ability to understand and grasp the meaning of something, such as reading material or spoken language.

White Space

The unmarked portions of a page or screen, used in design and layout to create visual clarity and improve readability.

Q1: Based on the preceding information,which of the

Q13: Based on the preceding information,what amount should

Q23: Based on the information provided,what amount of

Q25: During the third quarter of 20X8,Pride Company

Q30: The JPB partnership reported net income of

Q32: Which of the following statements best describes

Q33: Based on the preceding information,what amount of

Q35: Company Pea owns 90 percent of Company

Q39: Based on the preceding information,what is the

Q61: Based on the preceding information,what is the