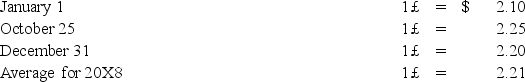

Michigan-based Leo Corporation acquired 100 percent of the common stock of a British company on January 1,20X8,for $1,100,000.The British subsidiary's net assets amounted to 500,000 pounds on the date of acquisition.On January 1,20X8,the book values of its identifiable assets and liabilities approximated their fair values.As a result of an analysis of functional currency indicators,Leo determined that the British pound was the functional currency.On December 31,20X8,the British subsidiary's adjusted trial balance,translated into U.S.dollars,contained $17,000 more debits than credits.The British subsidiary reported income of 33,000 pounds for 20X8 and paid a cash dividend of 8,000 pounds on October 25,20X8.Included on the British subsidiary's income statement was depreciation expense of 3,500 pounds.Leo uses the fully adjusted equity method of accounting for its investment in the British subsidiary and determined that goodwill in the first year had an impairment loss of 25 percent of its initial amount.Exchange rates at various dates during 20X8 follow:

-Based on the preceding information,in the stockholders' equity section of Leo's consolidated balance sheet at December 31,20X8,Leo should report the translation adjustment as a component of other comprehensive income of:

Definitions:

Direct Labor

Wages paid to workers directly involved in the production of goods or services, as opposed to administrative or managerial staff.

Manufacturing Overhead

All the indirect costs associated with producing a product, which may include the cost of utilities, depreciation of manufacturing equipment, and salaries of managerial staff.

Conversion Cost

The combined costs of direct labor and manufacturing overheads that are incurred in the process of converting raw materials into finished goods.

Manufacturing Overhead

Indirect factory-related costs that are incurred when a product is manufactured, including costs like rent, utilities, and maintenance of equipment.

Q4: A parent sold land to its partially

Q6: Which of the following is true? When

Q16: Customary Review<br>A)Provides preliminary information to investors about

Q24: Accounting and Auditing Enforcement Releases<br>A)Provides preliminary information

Q33: Based on the preceding information,what amount of

Q43: Assume Push sold the inventory to Shove.Using

Q47: When is a partnership considered to be

Q50: Based on the preceding information,what amount will

Q58: In 20X6,Dorian City received $15,000,000 of bond

Q87: Following are four independent transactions or events