On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

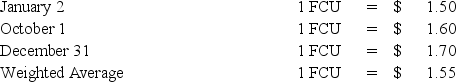

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

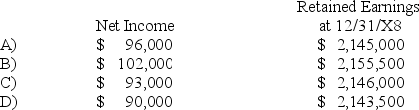

-Refer to the above information.Assuming the FCU of the country in which Ski Company is located is the functional currency,what are the translated amounts for the items below in U.S.dollars?

Definitions:

Food Choices

The decisions individuals make regarding the selection of food based on taste, convenience, nutrition, and other personal factors.

Nutrition Counseling

A professional practice focusing on helping individuals achieve healthier dietary habits and lifestyles through personalized advice and guidance.

Unique Personalities

The distinct set of characteristics, traits, and behaviors that make each individual different from others.

Counseling Process

A structured method undertaken by counselors and clients to explore problems, identify solutions, and develop strategies for change and improvement.

Q17: In reading a set of consolidated financial

Q31: Based on the information provided,the gain on

Q35: Transaction: Received contributions restricted by donors for

Q43: Which of the following statements is (are)true?<br>I.In

Q44: Based on the preceding information,the entries made

Q52: Based on the information given above,what will

Q55: Based on the preceding information,at what dollar

Q57: Based on the information given above,what amount

Q58: Refer to the above information.Assuming the FCU

Q59: Based on the preceding information,what journal entry