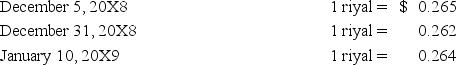

On December 5,20X8,Texas based Imperial Corporation purchased goods from a Saudi Arabian firm for 100,000 riyals (SAR) ,to be paid on January 10,20X9.The transaction is denominated in Saudi riyals.Imperial's fiscal year ends on December 31,and its reporting currency is the U.S.dollar.The exchange rates are:

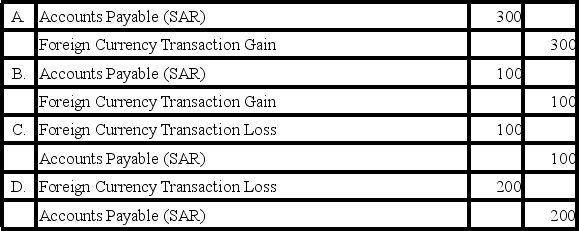

-Based on the preceding information,what journal entry would Imperial make on January 10,20X9,to revalue foreign currency payable to equivalent U.S.dollar value?

Definitions:

Face Value

The original cost of a bond or the principal balance to be paid back at maturity, excluding interest.

Market Interest Rate

The prevailing rate at which interest is charged on loans and bonds in the broader financial market.

Bond Yield

The return an investor realizes on a bond, calculated by the coupon payments relative to the market price of the bond.

Face Value

The nominal or dollar value stated on a financial instrument, such as a bond or stock, representing its worth at issuance or maturity.

Q22: Refer to the information provided above.Using a

Q28: Based on the preceding information,what amount of

Q28: What does an underwriter typically require from

Q30: Based on the preceding information,what amount will

Q32: In which of the following situations do

Q32: The following information is contained in the

Q41: When deficiencies are found in a registration

Q42: A debt service fund for the City

Q50: The partnership of X and Y shares

Q65: Which combination of accounts and exchange rates