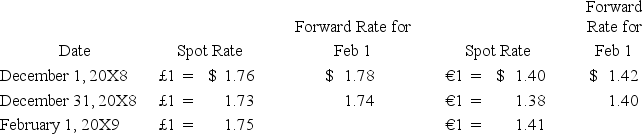

On December 1,20X8,Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78.On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9.Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9.Ignore taxes.

-Based on the preceding information,what is the overall effect of speculation on 20X9 net income?

Definitions:

MH

Often used as an abbreviation for "machine hours," representing the amount of time machines are operated in the production process.

Variable Overhead Rate Variance

The difference between actual variable overhead incurred and the standard cost allocated based on activity level.

Variable Overhead Rate Variance

The difference between actual variable overhead costs incurred and the standard variable overhead costs expected for the actual production level.

Fixed Manufacturing Overhead Budget Variance

The discrepancy between the budgeted fixed overhead costs and the actual fixed overhead incurred during production.

Q13: Based on the information provided,the gain on

Q17: Based on the preceding information,what amount of

Q20: Based on the information provided,what is the

Q24: Based on the preceding information,the cost of

Q44: Net income for Levin-Tom partnership for 20X9

Q44: Based on the preceding information,in the preparation

Q52: A city's museum is supported by a

Q56: During the third quarter of 20X4,Ripley Company

Q74: The Town of Pasco has no supplies

Q75: The general fund of Hatteras acquired a