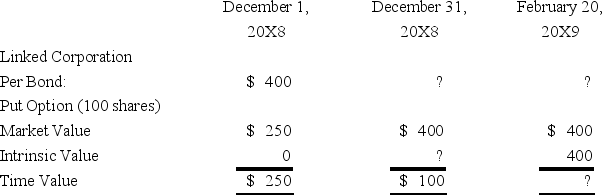

On December 1,20X8,Winston Corporation acquired 10 deep discount bonds from Linked Corporation at a cost of $400 per bond.Winston classifies them as available-for-sale securities.On this same date,it decides to hedge against a possible decline in the value of the securities by purchasing,at a cost of $250,an at-the-money put option to sell the 10 bonds at $400 per bond.The option expires on February 20,20X9.Selected information concerning the fair values of the investment and the options follow:

Assume that Winston exercises the put option and sells Linked bonds on February 20,20X9.

Assume that Winston exercises the put option and sells Linked bonds on February 20,20X9.

-Based on the preceding information,what is the market price of Linked Corporation bonds on February 20,20X9?

Definitions:

Total Proceeds

The entire sum of money received from a transaction or series of transactions, often before any deductions or expenses are taken into account.

Sustaining Stock Price

Efforts or strategies employed by a corporation to maintain or support the current market price of its shares.

Excess Cash

The amount of cash available exceeding what is necessary for day-to-day operations, often allocated for investment or returned to shareholders.

Business Relationships

The connections and interactions between a company and its customers, suppliers, partners, and other entities essential for its operation.

Q2: Based on the preceding information,what amount will

Q22: Based on the information provided,what amount was

Q29: Refer to the information provided above.How much

Q35: In accounting for governmental funds,which of the

Q39: Based on the information provided,what is the

Q42: Based on the information given above,what was

Q44: Sydney Company issued $1,000,000 par value 10-year

Q51: GASB 34 requires a reconciliation schedule for

Q52: Based on the preceding information and assuming

Q65: Which of the following observations is true