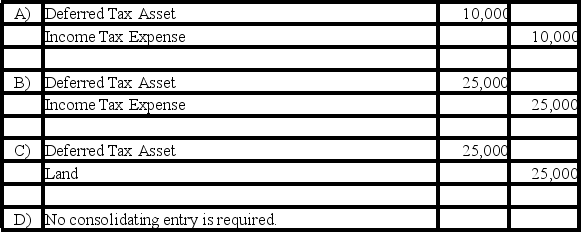

Company P holds 70 percent of the voting shares of Company S.During 20X8,Company S sold land with a book value of $125,000 to Company P for $150,000.Company P continues to hold the land at the end of the year.The companies file separate tax returns and are subject to a 40 percent tax rate.Assume that Company P uses the fully adjusted equity method in accounting for its investment in Company S.

-Based on the information given,which consolidating entry relating to the intercorporate sale of land is to be entered in the consolidation worksheet prepared at the end of 20X8?

Definitions:

Meaning

The significance or understanding conveyed by a word, phrase, sentence, or text.

Lymphangiosarcoma

A rare and aggressive form of cancer that develops from the lymphatic system, often associated with chronic lymphedema.

Combining Form

A linguistic element used in the construction of medical and scientific terminology that generally consists of a root and a vowel to ease pronunciation when combined with another form.

Cancer

A broad term for a large group of diseases characterized by the uncontrolled growth and spread of abnormal cells in the body.

Q7: On December 1,20X8,Denizen Corporation entered into a

Q9: The PQ partnership has the following plan

Q15: On March 1,20X8,Wilson Corporation sold goods for

Q18: On January 1,20X6,Pepper Corporation issued 10-year bonds

Q21: Puzzle Corporation acquired 100 percent of the

Q23: Trevor Company discloses supplementary operating segment information

Q43: Based on the preceding information,what was the

Q55: Blue Ridge Township uses the consumption method

Q56: Phobos Company holds 80 percent of Seimos

Q59: Based on the information provided,what amount of