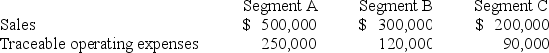

Trevor Company discloses supplementary operating segment information for its three reportable segments.Data for 20X8 are available as follows:

Allocable costs for the year was $180,000.Allocable costs are assigned based on the ratio of a segment's income before allocable costs to total income before allocable costs.The 20X8 operating profit for Segment B was:

Definitions:

Teamwork

The collaborative effort of a group to achieve a common goal or complete a task in the most effective and efficient way.

Constructive Purpose

Engaging in activities or behaviors with the intention to bring about positive outcomes, improvements, or benefits for oneself or others.

Recognition Programs

Initiatives or schemes designed to acknowledge and reward employees' achievements, contributions, and performance.

Employee Engagement

The emotional and intellectual commitment of employees to their work and workplace, which influences their willingness to learn and perform.

Q15: Under the modified accrual basis of accounting

Q20: Based on the preceding information,in the preparation

Q27: Refer to the information provided above.David invests

Q37: Refer to the information given.Assuming a current

Q48: Based on the preceding information,in the consolidating

Q48: Based on the preceding information,what is the

Q53: Based on the preceding information,the amount of

Q55: Based on the preceding information,at what dollar

Q64: Refer to the above information.Assuming the U.S.dollar

Q71: Prior to closing the accounts at the