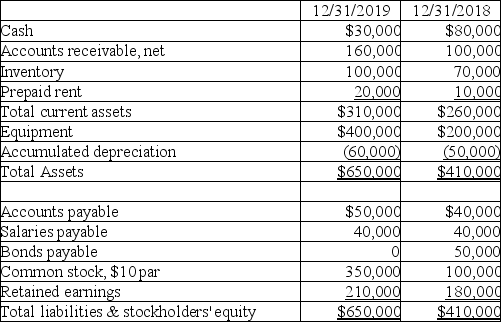

Matthauson Company has the following comparative balance sheet data available:

Additional information:

Additional information:

1.The company reports net income of $100,000 and depreciation expense of $20,000 for the year ending December 31,2019.

2.Dividends declared and paid in 2019,$70,000.

3.Equipment with a cost of $20,000 and accumulated depreciation of $10,000 was sold for $3,000.

4.New equipment was purchased for cash.

5.No common stock was retired during 2019.

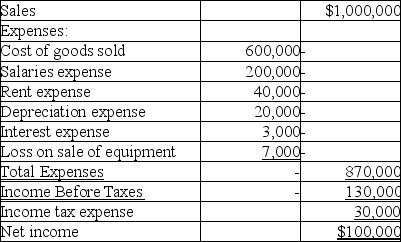

The company also reports the following income statement for the year ending December 31,2019:

Using the direct method,prepare the statement of cash flows for the year ending December 31,2019.

Using the direct method,prepare the statement of cash flows for the year ending December 31,2019.

Definitions:

Surplus

An excess of supply over demand, leading to a situation where goods and services exceed their consumption or utilization.

Rent Control

Government policies or laws that limit the amount landlords can charge for renting out a property, intended to make housing more affordable.

Demand Increase

This occurs when there is a rise in the quantity of a product or service that consumers are willing and able to purchase at a given price, often due to factors like increased income, changes in tastes, or population growth.

Supply Decrease

A supply decrease refers to a situation where the quantity of a good or service that producers are willing and able to sell at a given price level falls, often due to factors like increased production costs or regulatory changes.

Q2: Permanent differences are created by revenue and

Q9: Which of the following equations is correct?<br>A)

Q10: Financial accounting only recognizes transactions that have

Q34: Newsome Corporation had accounts receivable of $120,000

Q72: Some liabilities,such as accrued salaries and rent,are

Q87: Double taxation means that the:<br>A)corporation's income tax

Q104: Interest revenue for the current year is

Q106: Zemanowski Company reports the following sales figures

Q131: Depreciation expense is added to net income

Q143: The statement of cash flows will NOT