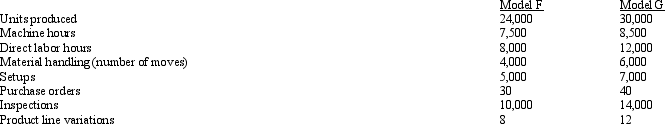

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

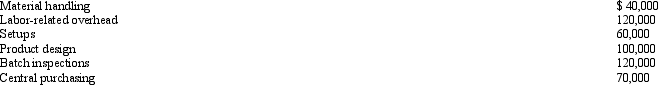

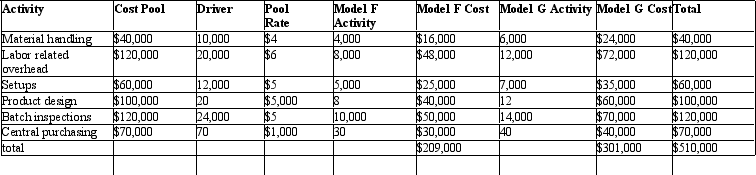

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below: Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under the equally accurate reduced ABC system, what are the global consumption ratios for Model F and Model G respectively? (round to 2 decimal places)

Definitions:

Harmonized Sales Tax

A combined tax that includes both federal and provincial sales taxes, applied to the purchase of goods and services.

Price Tags

Labels or stickers on merchandise displaying the price of the item.

Implied Value

The estimated value of an asset or company after considering factors not directly stated but suggested by available information.

Annual Dues

Annual dues are yearly fees paid by members to belong to an organization, club, or group, often providing access to benefits or services.

Q8: Figure 5-9 The Omega Company manufactures customized

Q8: Cost management systems are made up of

Q38: Figure 4-16 Samson Company recently installed an

Q51: Which of the following products would NOT

Q93: A pure service organization has<br>A) no raw

Q97: With multiple internal binding constraints, the optimal

Q98: Which of the following is a cost

Q160: What is the difference between a correlation

Q170: What is a disadvantage of assigning costs

Q180: The scatterplot method of cost estimation<br>A) is