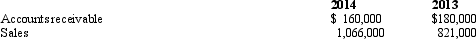

The following data exist for Weaver Company:

Calculate the receivables turnover and the average days' sales uncollected for 2014.(Round to 1 decimal point and even days,respectively. )

Definitions:

Look-Back Period

A period of time used to determine whether a business should make its Form 941 tax deposits on a monthly or semiweekly basis. The IRS defines this period as July 1 through June 30 of the year prior to the year in which Form 941 tax deposits will be made.

Form 941

A tax form used by employers to report federal withholdings from employee wages, including Social Security and Medicare taxes.

FUTA Tax Payable

A liability representing the federal unemployment tax that employers must pay on behalf of their employees to the IRS.

Payroll Tax Expense

The cost incurred by employers for taxes assessed on employee wages, including social security and medicare taxes.

Q12: Use this information to answer the following

Q16: The percentage of net sales method of

Q33: To analyze a capital investment using the

Q34: The following sales and quality-related data pertain

Q40: Under the allowance method,Uncollectible Accounts Expense is

Q57: Internal failure costs and prevention costs make

Q70: Jasmine Company has established a petty

Q87: Which of the following is not a

Q91: The minimum rate of return is also

Q127: Which of the following is an actual