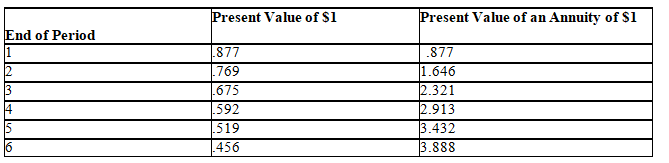

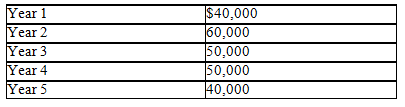

The following data have been gathered for a capital investment decision.The amounts relate to a 14 percent discount factor.

a.Compute the present value of the following cash flows.Use a discount rate of 14 percent.

b.What would have been the present value of the cash flows if they were received in equal installments over the five-year period at the same discount rate?

c.If the answers to parts (a)and (b)differ,explain the reason(s)why.

Definitions:

Primarily Liable

Being directly responsible or obligated in a legal or financial context, often referring to the party most accountable for fulfilling an obligation.

Authorized

Having official permission or power to do something or for something to take place.

Accepted Draft

An agreement or negotiable instrument that has been formally acknowledged by the addressee, promising to pay the specified amount by a certain date.

Obligated

Being legally or morally required to do something based on laws, regulations, agreements, or ethical principles.

Q11: A manager can improve the economic value

Q43: Why is it important that a manager's

Q58: The Fran Laurel,Capital balance on 1/1 was<br>A)$2,000.<br>B)$1,800.<br>C)$2,400.<br>D)$2,200.

Q71: The three techniques used to evaluate capital

Q74: The breakeven point is<br>A)where fixed and variable

Q113: Which of the following is an application

Q119: Which of the following statements is not

Q145: If targeted sales are 12,000 units,the sales

Q148: Contribution margin equals fixed costs plus<br>A)cost of

Q168: The alternative with the lowest payback period