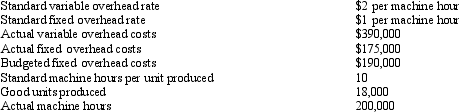

Underfoot Products uses standard costing.The following information about overhead was generated during May:

-Using the above information provided for Underfoot Products,compute the fixed overhead budget variance.

Definitions:

Accrued Expenses

Expenses that have been incurred but not yet paid or recorded, representing liabilities for services or goods received.

Tax Deductible

Expenses that can be subtracted from gross income to reduce the amount of income subject to tax, thereby lowering the tax liability.

Income Tax Rate

The percentage at which an individual or corporation is taxed on their income, which can vary based on the amount of income and the jurisdiction.

Deferred Tax Liability

A tax obligation recognized on a company's financial statements resulting from temporary differences between the tax basis of assets or liabilities and their reported amounts in the financial accounts.

Q21: "The difference between actual hours worked and

Q23: What are some items that can affect

Q25: A sales forecast for a retail organization

Q38: Opportunity costs are ignored for decision making.

Q43: The Logan Company specializes in decorative fruit

Q49: To analyze a capital investment using the

Q55: The company's minimum rate of return is

Q107: Which of the following is not an

Q126: If as of December 31,2014,the rent of

Q168: The alternative with the lowest payback period