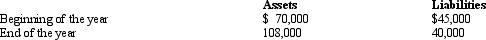

Following are the total assets and liabilities at the beginning and end of the year for Hagedorn Company:

Determine the net income or loss for the year in each of the following situations:

Determine the net income or loss for the year in each of the following situations:

a.The owner made no investments in the business and no withdrawals were made during the year.

b.The owner made an investment of $20,000 and withdrew $12,000 during the year.

Definitions:

NALA's Model Standards

Established guidelines by the National Association of Legal Assistants for the ethical and professional conduct of legal assistants.

Conflict-of-Interest Rules

Regulations designed to prevent situations where a person's personal interests could interfere with their professional obligations or duties.

Ethical Rules

Guidelines that govern the conduct of individuals and organizations, ensuring actions align with moral principles and professional standards.

Walling-Off Procedures

Strategies used within organizations to prevent the exchange of confidential information between departments or individuals to avoid conflicts of interest.

Q17: Betty purchased an annuity for $24,000 in

Q33: Due to the population change,the Goose Creek

Q48: Jerry purchased a U.S.Series EE savings bond

Q49: Paula transfers stock to her former spouse,Fred.The

Q79: The statement of owner's equity discloses the

Q104: Orange Cable TV Company,an accrual basis taxpayer,allows

Q114: Social considerations can be used to justify:<br>A)Allowing

Q116: Both economic and social considerations can be

Q121: For the negligence penalty to apply,the underpayment

Q216: A company purchases land and a building