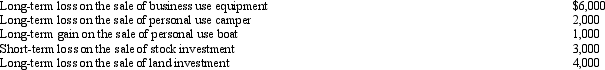

During the year,Marcus had the following transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Definitions:

Value-Clarifying Skills

Techniques or approaches used to help individuals identify and understand their values, beliefs, and priorities.

Interactional Skills

The abilities required to effectively communicate and engage with others within various social contexts.

Electoral Legislation

Laws and regulations governing the conduct of elections, including the procedures for voting, campaigning, and counting ballots.

Social Policy

Policies designed to address social issues and ensure public welfare, covering areas such as health, education, and employment.

Q6: Benita incurred a business expense on December

Q17: Which of the following must be capitalized

Q30: Which of the following is a deduction

Q32: In general,one partner acting alone cannot obligate

Q48: Which of the following is incorrect?<br>A)Alimony is

Q61: List at least three exceptions to the

Q63: Zack was the beneficiary of a life

Q63: Property can be transferred within the family

Q81: On January 1,2000,Yellow corporation issued 6% 25-year

Q119: Which of the following expenses is classified