Multiple Choice

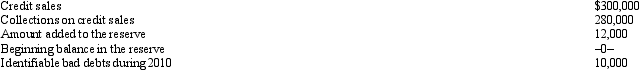

Swan,Inc.is an accrual basis taxpayer.Swan uses the aging approach to calculate the reserve for bad debts.During 2010,the following occur associated with bad debts.  The amount of the deduction for bad debt expense for Swan for 2010 is:

The amount of the deduction for bad debt expense for Swan for 2010 is:

Definitions:

Related Questions

Q1: Jason and Peg are married and file

Q11: Daniel purchased a bond on July 1,2010,at

Q12: Iris,a calendar year cash basis taxpayer,owns and

Q19: Explain the difference between tax avoidance and

Q44: In terms of the tax formula applicable

Q84: Terry and Jim are both involved in

Q106: In preparing his 2010 Federal income tax

Q116: Bridgett's son,Amos,is $4,500 in arrears on his

Q120: Due to a merger,Allison transfers from Miami

Q142: None of the prepaid rent paid on