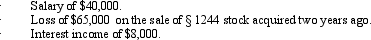

John files a return as a single taxpayer.In 2010,he had the following items:  Determine John's AGI for 2010.

Determine John's AGI for 2010.

Definitions:

Environment

The surrounding conditions and factors that influence the living and non-living elements present in it.

Nutrient-rich Blood

Blood that is especially high in essential nutrients like vitamins, minerals, and oxygen, essential for maintaining healthy bodily functions.

Umbilical Cord

The flexible cord-like structure connecting a fetus to the placenta, delivering nutrients and removing waste.

Placenta

A structure that forms in the uterus while pregnant, which supplies the fetus with oxygen and nourishment while eliminating its waste.

Q16: Diane contributed a parcel of land to

Q27: The First Chance Casino has gambling facilities,a

Q58: A taxpayer who claims the standard deduction

Q65: In December 2010,Emily,a cash basis taxpayer,received a

Q67: Employee business expenses for travel qualify as

Q73: In 2010,Juan's home was burglarized.Juan had the

Q73: Amos is the sole shareholder of an

Q86: Tara owns a shoe store and a

Q119: ABC Corporation mails out its annual Christmas

Q135: A participant has a zero basis in