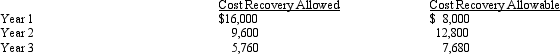

Tara purchased a machine for $40,000 to be used in her business.The cost recovery allowed and allowable for the three years the machine was used are as follows:  If Tara sells the machine after three years for $15,000,how much gain should she recognize?

If Tara sells the machine after three years for $15,000,how much gain should she recognize?

Definitions:

Fixed Manufacturing Overhead

The portion of manufacturing overhead costs that remains constant regardless of the level of production.

Variable Costing

An accounting method that considers only variable production costs (costs that change with the level of output) in the calculation of product costs.

Unit Product Cost

The total cost associated with producing one unit of a product, including both variable and fixed costs.

Variable Costing

An accounting method that includes only variable production costs (direct labor, direct materials, and variable manufacturing overhead) in product costs.

Q40: Self-created intangibles are generally not § 197

Q43: Peggy is in the business of factoring

Q53: Turquoise Company purchased a life insurance policy

Q56: After the divorce,Jeff was required to pay

Q69: Mattie and Elmer are separated and are

Q72: The cost of legal advice associated with

Q73: In 2010,Juan's home was burglarized.Juan had the

Q94: In order to protect against rent increases

Q95: On May 30,2010,Jane signed a 20-year lease

Q101: The cost recovery method for all personal